Refund payment

Merchants can refund all or part of a captured amount for up to 365 days after the payment request was approved.

Refunds usually reach the customer's account within 2–3 bank days, but can take up to 10 days depending on the bank(s).

Country-specific rules:

| Country/Region | Refund destination | Notes |

|---|---|---|

| Norway & Sweden | Same card as in the original transaction | If the card is no longer valid, the merchant must contact the customer to arrange an alternative refund method. |

| Finland & Denmark | User's receiving account set in the MobilePay app | May differ from the account or card used for the original payment. |

- You can't refund more than the captured amount.

- Refunded funds are deducted from the merchant's settlement account after two business days. See Settlements for details.

- Refunds past the 365-day limit will return

HTTP 400 Bad Request. See HTTP 400 Bad Request for details.

We limit refunds for old payments to avoid issues such as expired cards, changed banks, or customers moving or passing away, which often require manual work.

Some refunds can also be done in the business portal.

Partial refunds

A partial refund is issued by specifying an amount lower than the captured amount.

The refunded amount can never exceed the captured amount.

You can make several partial refunds until the full captured amount has been refunded. You should cancel the remaining reservation after a partial capture.

- A partial capture is typically confirmed in the bank within 3–10 days, though it may take longer.

- Once completed, the bank makes the remaining funds (e.g., 250 NOK) available in the customer's account.

- This process is fully dependent on the customer's bank. Vipps MobilePay cannot speed it up.

Example

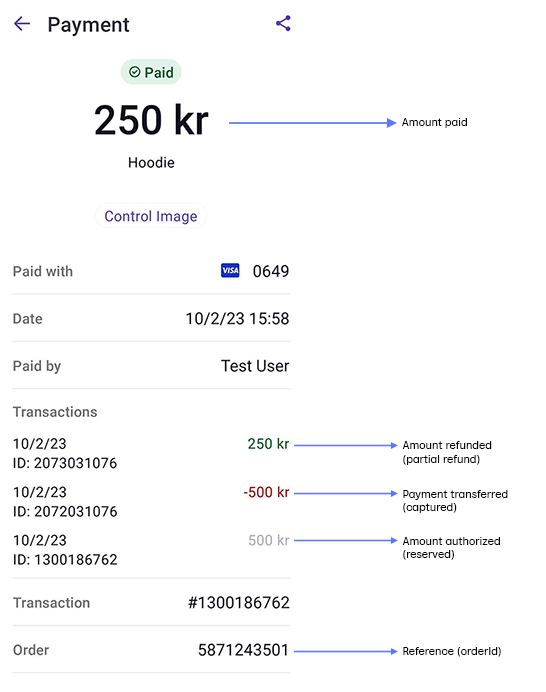

A customer orders two items for a total of 500 NOK.

The merchant reserves and captures the full amount (500 NOK).

The customer decides to keep only one item priced at 250 NOK.

The merchant refunds 250 NOK.

- Transactions are shown in reverse chronological order (oldest at the bottom).

- Authorized/reserved amounts are in faint gray (e.g.,

500 kr). - Captures appear as negative red transactions (e.g.,

-500 kr). - Refunds appear in green (e.g.,

250 kr) and update the total paid.

Troubleshooting

Customer hasn't received the refund

-

Check the refund status

Confirm that the refund request was successful by checking the payment or charge status in the same API you used to create the payment and refund:

If you created the payment using Checkout API, use the ePayment API to process the refund.

-

If the refund failed, investigate why:

- The refund must be made within 365 days of the payment request.

- The refund amount cannot exceed the captured amount.

- The card must still be valid.

- The user must still have an active account.

-

If the refund succeeded, but the customer hasn't seen the money:

For customers in Denmark or Finland:

- Refunds are sent to the receiving account defined in the MobilePay app.

- This may differ from the original payment account or card.

- Ask the customer to check their registered receiving account.

For customers in Norway or Sweden:

- Refunds are sent to the same card used for the original transaction.

- If the card is no longer valid, contact the customer to agree on an alternative refund method.

-

Still no luck?

If both the refund status and payout details check out, contact Business Support for further investigation.

API guides

You can refund a payment using these API methods:

- ePayment API – Refund a payment

- Recurring API – Refund a charge

- eCom API (Norway only) – Refund a payment

If you created the payment using Checkout API, use the ePayment API to process the refund.